- 🙁 5Y? no growth

- 🙂 CDY 1.8%.. 53Y dividend-king, according to https://www.suredividend.com/dividend-kings/

- .. verified on https://www.macrotrends.net/stocks/charts/ABM/abm-industries/dividend-yield-history

- analyst OK $55 https://money.cnn.com/quote/forecast/forecast.html?symb=abm

- mid-cap

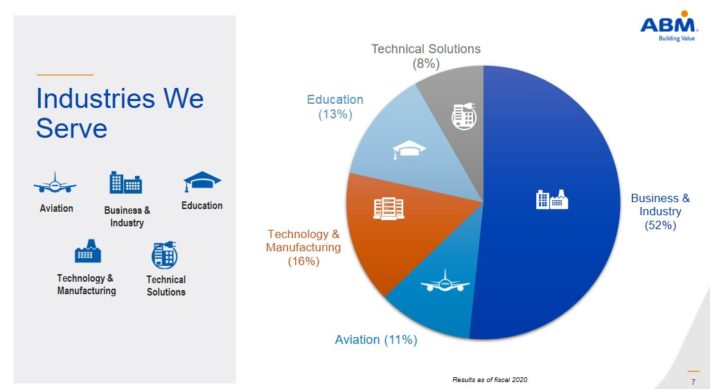

Shares also look significantly undervalued, with a fiscal 2021 price-to-earnings ratio of 12.2, which is well below our fair value estimate of 17.5. ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking.