- 🙁 no div so far, after early 2020

- .. 🙁 babysitting needed. A saving grace — established business, even though not as good as PG or MSFT.

- analyst positive. tgt 75 https://money.cnn.com/quote/forecast/forecast.html?symb=gm

- 🙂 bought at $34.6

Category: buySimpleName

Excludes ETF or Reit

170>PG 2% #

- existing position: $64 invested at $160/share

- 🙁 https://www.morningstar.com/articles/1076129/12-overvalued-mega-cap-stocks-to-avoid

- 🙂 CDY 2%.. 50Y dividend-king, according to https://www.suredividend.com/dividend-kings-nfg/

- .. verified on https://www.macrotrends.net/stocks/charts/PG/procter-gamble/dividend-yield-history

- 🙂 40Y up https://www.macrotrends.net/stocks/charts/PG/procter-gamble/dividend-yield-history

- analyst lukewarm.. $169 https://www.tipranks.com/stocks/pg/forecast

- $380B large cap. cash-cow + long-term growth, although long past the growth phase

15>ET:US #

- See brief comparison with other mid-stream high-div stocks: https://www.marketbeat.com/stocks/NYSE/am/dividend/

- 🙂 CDY 15% now 6%

- 🙂 div maintained through 2020 — https://www.nasdaq.com/market-activity/stocks/et/dividend-history

- .. slight drop recently

- 🙂 analyst rating high. Tgt $15 https://money.cnn.com/quote/forecast/forecast.html?symb=ET

- 🙂 price tag $7 .. quicker due diligence with smaller experiments

- 🙂 bought $6.56

- 🙂 3M price trend not as low as other stocks

- fairly established with market cap 20B

SNP/PTR/SHI #Chn big oil

— Sinopec 中石化

- 🙂 div maintained through 2020. CDY 6.6% https://www.nasdaq.com/market-activity/stocks/snp/dividend-history

- established $70B

- no analysts, so buy up to 1 share, using fractional

— PetroChina

- 🙂 div maintained through 2020. CDY 7% .. https://www.nasdaq.com/market-activity/stocks/ptr/dividend-history

- established $110B

- no analysts, so up to $90

— SHI (Shanghai PetroChem)

- div reduced through 2020. CDY 6.5% .. https://www.nasdaq.com/market-activity/stocks/shi/dividend-history

- no analysts, so up to 3 shares

— Not supported on Robinhood: CNOOC 中海油

🙂 div maintained through 2020. around 4.5% https://www.nasdaq.com/market-activity/stocks/ceo/dividend-history🙂 analysts 100%🙁 price tag $100 so need to buy fractional up to $100established $50B

KT@Korea

- 🙁 div STOPPED in 2020. http://www.businesskorea.co.kr/news/articleView.html?idxno=57361

- 🙁 No dividend in 2014-16 ..

- https://www.morningstar.com/stocks/xnys/kt/dividends shows last exDiv 30 Dec 2020.

- established $5B Korean big telco/media

PKX 5%+ #Korean steelmaker

- div maintained through 2020, but low CDY 2%.. https://www.nasdaq.com/market-activity/stocks/pkx/dividend-history, so invest up to 1 shares, using fractional

- 🙂 analysts BUY

- established $20B Korean steel maker

NWBI 5% small bank

- CDY 5%+

- 🙂 25Y streak (almost no-drop) .. https://www.macrotrends.net/stocks/charts/NWBI/northwest-bancshares/dividend-yield-history

- 25Y price chart (above) shows growth.

- 🙂 low quantum

- analysts neutral .. tgt $14 https://money.cnn.com/quote/forecast/forecast.html?symb=nwbi

- $2B- small cap, long history as a regional bank, not a growth stock

SRE 3.4% div grower since2000 #Sempra

- big quantum. Needs fractional

- 🙂 12M not recovered.

- 🙂 div no cut since 2000. CDY 3.4% https://www.macrotrends.net/stocks/charts/SRE/sempra-energy/dividend-yield-history

- 🙂 analyst no-sell

- 40B utility stock

BAESY 5%

- no fractional allowed

- 🙂 5% CDY https://www.dividend.com/stocks/industrials/aerospace-defense/defense-primes/baesy-bae-systems-plc-adr/

- .. Consecutive years of stable or rising dividend: 21Y, according to Kiplinger

- 🙂 analyst no sell. tgt $33

- recent drop; 3M up-trend; 12M up

- https://www.kiplinger.com/investing/stocks/602578/european-dividend-aristocrats-international-stocks .. Britain’s largest defense contractor

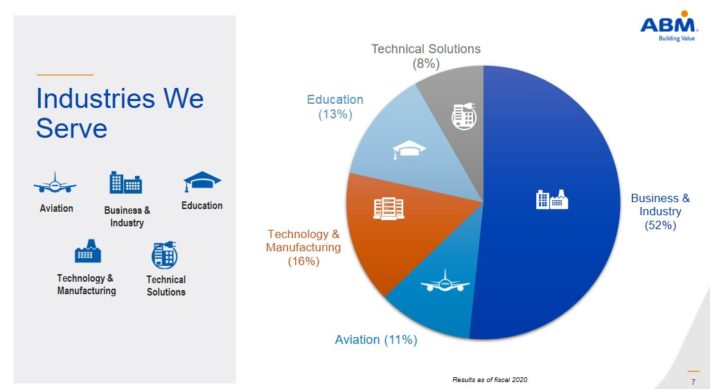

55>ABM 2% facility service #

- 🙁 5Y? no growth

- 🙂 CDY 1.8%.. 53Y dividend-king, according to https://www.suredividend.com/dividend-kings/

- .. verified on https://www.macrotrends.net/stocks/charts/ABM/abm-industries/dividend-yield-history

- analyst OK $55 https://money.cnn.com/quote/forecast/forecast.html?symb=abm

- mid-cap

Shares also look significantly undervalued, with a fiscal 2021 price-to-earnings ratio of 12.2, which is well below our fair value estimate of 17.5. ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking.