How does CAD and additional potential health declines affect my answer?

- [1] Both of us don’t need to work@@. using a frugal standard.

- 松一口气65^end@college #U.S.

- [2] Each monthly wage extends Fuller wealth by2M

- Excel formula2reference number embedded]text .. links to a spreadsheet. It could be more (or less) updated than this bpost.

As of 2021, we have a fully paid home enough for 4. I will also earmark enough for two FRS cpfLife accounts. Such a high_ground is an achievement, but might be harder to maintain after SBH.

Q: Beyond those assets, what level of nest egg would preempt/eliminate the need to migrate to the U.S.?

A: I used to (and still sometimes do) feel the cautious answer is $3M. However, based on the below assumptions, we need SGD 800-1600k to justify shelving the U.S. migration idea.

- Assumption 1a: in terms of SGD monthly burn rate [excluding tax outlays, including bx], I will assume S$5-6k total outlay is “comfortable” even after the recent (2022-24) elevated inflation

- Assumption 1b: in terms of Singapore salary.. for simplicity I will pick a nice number of $100k/Y from age 47 to 55, but $0 afterwards (in Singapore) -> 700k work income.

- ^ ^ Those are the big assumptions ^^

- Assumption 2: after kids grow up, we really don’t need more than $1500/person (inflation considered), so FRS cpfLife can be sufficient

- Assumption 3: Unlike [1], I may choose to set aside an elastic S$100-200k/child for college -> up to S$400k.

- Assumption(methodology) 4: Count cpfLife but Ignore NNIA + inheritance + grown-up children’s contribution + ..

- No assumption about lease spread on HDB flat, even after 2035, since grown-up children may stay with us.

— the calc done in Nov 2021, before selling the #1173 home. I have the spreadsheet in github.

- Nov 2021 to 2035 when meimei graduates, we need 6k * 12M * 14Y = 1008k, marginally higher than [1]

- 2036 to Jan 2039 wife+I need 36k * 3Y ≅ 110k, matching [1] 100%

- Sometime before Jan 2039, top up 200k to my cpfRA to the max, ignored in [1]

- 2039 to 2043 we need only $0 assuming my cpfLife ERS starts paying around $3k/M (as I would max out on my cpfLife). This amount is explicitly ignored in [1].

- Sometime before Aug 2043, top up wife’s cpfRA by an increment of [$0] to generate $0/M payout. Together we need only $3k/M payout. This amount is explicitly ignored in [1].

- ^ ^ ^ Adding 400k [Assumption 3] to the above ≅ 1720k total outlay ^ ^ ^

- 700k total salary according to Assumption 1b

- nest_egg_needed = S$1020k, excluding our CPF balance as of Nov 2021

However, I stand resolute against lifestyle creep, so S$5k/M is more than enough, and S$200k/child is unnecessary luxury.

— Some implications

Looks like my nest egg is barely enough to justify staying in SG for good !?

Need more analysis from different angles before I would feel assured.

Based on the above analysis, the #1 j4/advantage of U.S. migration is … dev-till-70. Right now with my MLP job I can extend my Fuller Wealth quite fast thanks to low burn rate, acceptable health conditions …. So I would go to U.S. only when I could “extend” faster in the U.S.

— Q: why most of my middle-class peers don’t feel so self-confident if they are in my (financial) shoes?

A1: Assumption 1a amount needs to balloon to 10k+ for them

A2: Assumption 2 amount needs to balloon to 6k for them

A3: Assumption 3 amount may not suffice for them

— Q4: what type of portfolio adjustments would improve my high ground and help obviate/preempt forced flee to the U.S.?

- term insurance for occupational disability till 65?

- more NNIA with limited appreciation, such as SgCP on mtg? Hig ground would sink. Poor liquidity , heavy debt.. TBD.

- USD 100k into SP500 .. no loan. Better buy-n-forget, more like rEstate, but lower DYOC than some rEstate.

- more NNIA with USD 100k into div stocks .. (hard to imagine myself persuaded) with some growth potential? Too risky. My high ground would sink.

- USD 100k into growth stocks? even more risky.

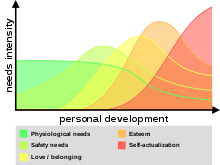

This diagram from

This diagram from