- 🙁 big quantum $90 .. fractional

- $7B long established

- 🙂 one of the aristocrats

- 🙂 div increased through 2020. CDY 5% .. https://www.nasdaq.com/market-activity/stocks/frt/dividend-history

Tag: t_divB

National Grid of UK 4%

- 40B established, part of the FTSE 100. probably a monopoly. millions of gas customers and millions of electricity customers.

- dividend maintained through 2020, but unstable. CDY 4% https://www.nasdaq.com/market-activity/stocks/ngg/dividend-history

- 🙂 3/12M chart not recovered yet

- 🙂 analysts positive

170>PG 2% #

- existing position: $64 invested at $160/share

- 🙁 https://www.morningstar.com/articles/1076129/12-overvalued-mega-cap-stocks-to-avoid

- 🙂 CDY 2%.. 50Y dividend-king, according to https://www.suredividend.com/dividend-kings-nfg/

- .. verified on https://www.macrotrends.net/stocks/charts/PG/procter-gamble/dividend-yield-history

- 🙂 40Y up https://www.macrotrends.net/stocks/charts/PG/procter-gamble/dividend-yield-history

- analyst lukewarm.. $169 https://www.tipranks.com/stocks/pg/forecast

- $380B large cap. cash-cow + long-term growth, although long past the growth phase

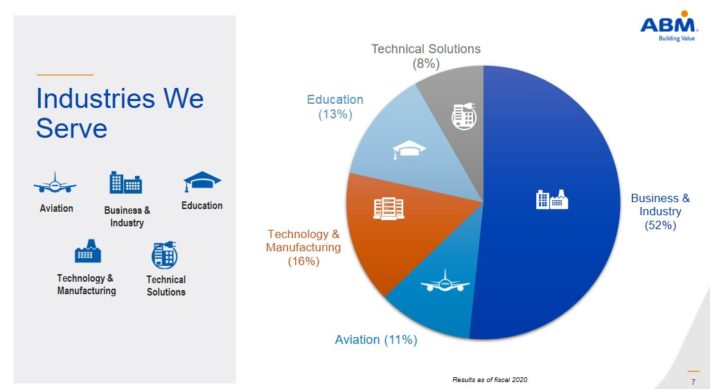

55>ABM 2% facility service #

- 🙁 5Y? no growth

- 🙂 CDY 1.8%.. 53Y dividend-king, according to https://www.suredividend.com/dividend-kings/

- .. verified on https://www.macrotrends.net/stocks/charts/ABM/abm-industries/dividend-yield-history

- analyst OK $55 https://money.cnn.com/quote/forecast/forecast.html?symb=abm

- mid-cap

Shares also look significantly undervalued, with a fiscal 2021 price-to-earnings ratio of 12.2, which is well below our fair value estimate of 17.5. ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking.

$9>SMFG 4% #add $20..40

- 🙁 🙁 SMFG/MUFG/MFG no growth stocks

— SMFG: up to $100 or $200

- 🙁 3M up

- 🙂 div increased through 2020, currently 4%

- 🙂 analyst rating excellent .. tgt $8.9 https://money.cnn.com/quote/forecast/forecast.html?symb=smfg

- 🙂 bought at $6.5

- $50B

SJI 5% #util

- 🙂 CDY 5%

- 🙂 33 Y streak .. https://www.macrotrends.net/stocks/charts/SJI/south-jersey-industries/dividend-yield-history

- 30Y trend good, but 5Y decline

- analysts neutral. tgt $25 https://www.tipranks.com/stocks/sji/forecast

- $3B mid-cap

VOD 6% #$80 planned but added $33

- 🙁 3M up; 12M up; 5Y down… low-growth high-yield cash cow ?

- 🙂 7% CDY, maintained through 2020

- 🙂 analyst positive.. tgt $22 .. http://markets.money.cnn.com/research/quote/forecasts.asp?symb=vod

- 🙂 small quantum

- I bought at $15.8. Small gain

$125>ABT 2%- Abbott #add$50..100

- 🙁 https://www.morningstar.com/articles/1076129/12-overvalued-mega-cap-stocks-to-avoid

- 🙂 CDY 1%+.. 50Y dividend-king, according to https://www.suredividend.com/dividend-kings-nfg/

- .. verified on https://www.macrotrends.net/stocks/charts/ABT/abbott-laboratories/dividend-yield-history

- 🙂 40Y up https://www.macrotrends.net/stocks/charts/ABT/abbott-laboratories/dividend-yield-history

- 🙂 long-term growth + cash-cow

- analyst mostly positive late May $140 https://www.tipranks.com/stocks/abt/forecast

- $200B mega cap

65>NFG 3% gas #wanted $100; invested $80

- 🙂 CDY 3% (was 4% when trading lower).. 50Y dividend-king, according to https://www.suredividend.com/dividend-kings-nfg/

- .. verified on https://www.macrotrends.net/stocks/charts/NFG/national-fuel-gas/dividend-yield-history

- analyst OK $65 https://money.cnn.com/quote/forecast/forecast.html?symb=nfg

- 5Y? no trend, but 3Y up, 10Y up

- $5B midcap

https://www.suredividend.com/dividend-kings-nfg/ has lots of details.