My first look at the world of pretty women, like my wife.

Most glamorous women marry businessmen, not high-ranking officers, MNC managers…

Phyllis Quek?

I have noticed some glamorous women choosing a husband outside the richest elite. If she misses her “chance” during her best years, then she can consider staying single all the way. Teresa Teng was one of the first to practice these principles.

Many glamorous women in show business could , if they want to, follow Teresa and save up enough over a few years to provide a lifetime of income [1] for her entire family and even her extended family. So there’s no need to sacrifice the more important things for the sake of money. What are the more important things?

- #1 important thing: Statistically, the wealthy man tends to receive too much temptation and attention from younger women. They get “it” without effort. In fact, they need huge effort to resist the temptations. Just ask MingLiang. To the glamorous women, Fidelity is mandatory and non-negotiable, a bedrock of the marriage and the family.

- important thing: Statistically, the wealthy man tends to be too busy with work, and not so devoted to his family.

- important thing: deep respect and sense of equality. The powerful, wealthy man often look at a glamorous women as an object, or a trophy, not so much as an equal partner.

- .. When things get bad, the man is likely to trash the women as a worthless old woman.

- .. As glamorous women age, they need dignity, which requires certain level of wealth.

- important thing: overall honor and decency. Statistically, it’s relatively hard to find a decent wealthy man.

- important thing: Wellness? I would say a good husband help keep every family member in good health.

So I think an ideal man for a glamorous women should first and foremost be a loyal, reliable man with proven track record of loyalty, dedicated to the family. Romantic perhaps. Attractive? Of course since the woman in question has too many choices and has no reason to consider a man not attractive to her.

The man’s political/economic power, fame, influence and wealth are not essential to a glamorous woman. She probably has some of that in her self. However, some women are ambitious.

Most glamorous women marry someone older, but some don’t, because an older man attracted to a young glamorous woman can easily get seduced by an even younger woman.

Emily Chang was one of the most attractive women in the world — young, bright, bold, an Asian female (and gorgeous) face in male-dominated Silicon Valley… a breath of fresh air. Then her youthful face grew old.

I feel more than 60% of the audience is male, and males are attracted by a youthful, pretty face. I guess a mainstream, competitive global media power house that’s the flagship of Bloomberg’s entire technology franchise can’t have a 40-something women as the figurehead.

How about my wife? She was a pretty girl, not a magazine cover girl. I think she chose wisely and she is lucky.

— marry “lower”

- Lin Chi-ling

- Teresa Teng

- Charlie Yeung

- Zoe Tay

- Gigi Leung

These glamorous women each chose a man “lower” in wealth and economic power. In a way, each glamorous woman above has made enough money and doesn’t need more money. She does need respect[3] and equality in marriage. Having higher economic power provides her a safety. Once she commits to a marriage, she becomes extremely vulnerable. She would have a marriage to protect. She may have kids to protect. Statistically, marriage failure within her circle was higher than average, perhaps as high as 30%.

The power, wealth, good looks.. on the groom’s side is a hazard.

Therefore, these glamorous women were shrewd. They know their priority, their weaknesses/vulnerabilities, their liabilities (累赘).

— [3] respect .. I think respect is really precious, esp. for pretty women without professional or business capabilities. These personal capabilities provide respect + livelihood. Without those capabilities, a reputable college degree would also bestow some respect + status.

For some of these women, fitness and body shape also provide respect. In contrast, healthy longevity is not a common priority, but look at Angelina’s mastectomy decision.

For my wife, bearing 2 kids gave her a solid, irreplaceable, central position in the family.

New smartphone and nice apparel provide some basic status. There are economical but nice choices.

— [1] Fuller wealth vs exclub — Since this is posted to a blog on personal finance, I would say a key question for the glamorous woman was burn rate control. (Applicable to sports superstars and any celebrity.)

Exclub (and status, public image) is important to glamorous women (not necessarily a celebrity) simply because she draws a lot of attention.

She has to be conscious of her limited shelf life, her peak earning age, and the dangerous concept of the exclusive club, which consists of wealthy man and young glamorous women, but who is forever young?

If she aims to join and stay in the exclusive club, then her burn rate would be 10 times higher than the average family in the locality. Such a burn rate would be unsustainable given that she has no long-term earning power to match the males in the exclub.

Instead of the exclub, she can focus on Fuller wealth.

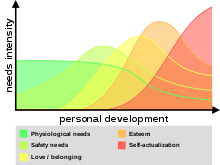

This diagram from

This diagram from