My concept of Chn’s middle class is mostly-urban, white-collar, usually college-educated. A concept confirmed in a book by XS.L (梁晓声 Xiaosheng.Liang).

When I interact with my relatives, ex-classmates, /repatriated/ ex-colleagues, repatriated young graduates (acquaintances) … I often have a vague, unfounded livelihood assumption that the Chinese middle-class has some advantages + some disadvantages[2] vis-a-vis SG middle-class counterpart, but on balance equally well-off. This assumption has a theoretical cornerstone — the middle-class’s definition. This definition implies that the middle-class in any country is well-off (小康富足) although the numerical criteria depend on location. Those criteria are vastly different in Bayonne vs 天津 vs 建德 vs Cambodia vs Manila due to PPP-FX.

[2] A lot of times, I could feel a strange sense of inferiority. Highly distorted and irrational. This is the same illusion as (not similar-to)

- my distorted illusion that HwaChong JC and NUS were possibly perceived as inferior to 实验 and Tsinghua.

- my distorted illusion that 实验 was somehow inferior to 四中, when both high schools produce top graduates on par with each other

- my distorted illusion that Singapore was a /backwater/ compared to Hongkong or Shanghai

In this blogpost, I want to point out some of the hidden but crucial differences between SG and Chn middle class livelihood. Not a Chn-watcher, I won’t go in-depth. Mostly based on hearsays, but from trusted sources such as serious intellectuals.

- :(▼healthcare .. different people in Chn and SG give me very different descriptions. I feel well taken care of in SG. XS.L said for many lower middle-class families, a medical event could sink the family to cashflow low ground, and grandpa agreed.

- 🙁 long-term inflation .. hurts the retirement livelihood. I feel confident about SG esp. the medium term.

- :(▲precarious .. worry about drop-out from middle-class exclub , as XS.L described. I feel secure. Overall, in SG there is some level of safety net, perhaps not as strong as in the western welfare states.

- 🙁 full-time nursing .. this cost is relatively affordable in SG (thanks to foreign workers) but very high according to my parents’ earnest market research.

- 👍 food, transport, outpatient medical .. probably cheaper in Chn.

- difference: CRBR .. My parents have adequate pension. Not sure about the 20Y prospect for current cohort of middle-class. I feel most of the middle-class in Chn or SG don’t feel very safe about retirement income. However, CPF-life is better than nothing.

- 🙁 environment .. PAP government has a reputation for tackling long-term environmental challenges

- 🙁 caring society .. (for the /vulnerable/, but hey folks do drop out of middle-class, as XS.L pointed out.) I feel Singapore is overall a slightly more caring society than the Chinese cities I know. Vague feeling. If I have to be specific, then most of the reasons are related to government services; some nonprofit organizations and individuals also play a part.

- 👍▼Chn’s economy will keep growing at a speed higher than SG. However, in the foreseeable future, living standard will remain lower than SG. Chn is decelerating more rapidly than SG which has reached maturity decades ago. It remains to be seen if faster growth translates to better livelihood for Chn’s expanding middle-class.

- — Some differences are not exactly about “livelihood”:

- 🙁 aspiration for branded degree .. harder to achieve for the Chn middleclass, partly due to lower absolute income. Large portions of the urban middleclass aspire to an overseas education/experience.

- 👍 gap from median .. Suppose we compare the ratio of middle-class household income to the national median. Somehow, I feel the Chn counterparts “enjoy” a higher ratio than the SG counterparts. If (a big if) that’s the case then the Chn middle class feel more self-conceived superiority and satisfaction (Shuo.L) than SG middle class would. How important is this self-esteem?

— 🙁 Difference: housing … The most intriguing difference. If a Chn middle class family of 3 could avoid buying a 2BR home [3] in a tier-1 city, then livelihood pressure can be tolerable. I just don’t know how many of the urban middle-class can avoid it. They are drawn into it by some invisible force, unable to free themselves.

[3] XS.L specified 70 sqm 居住面积 for an a stereotypical white-collar young couple planning to have kids, but XS.L didn’t say Tier-1 city.

Tier-1 city’s home price is comparable to, if not above, SG condo (at least 100% above HDB flats) but typical Tier-1 city salary is still lower than SG. The price tag is so large as to require contributions from 3 generations of a middle-class family, as XS.L confirmed. When we compare livelihood, this price tag is the elephant in the room.

I used to feel this peer pressure was exaggerated by the media, but XS.L, my parents, and my Chn bachelor colleagues all confirmed that this peer pressure is both pervasive and entrenched.

A major factor is mate selection, which affects entire families! Girls often demands not only a tier-1 city dowry home, but a 100 sqm [grandpa said, 建筑面积] home. So if you have a bachelor son, can your family avoid “it”?

— personal medical reserve .. This is not a SG^Chn difference per see, but quite relevant.

In the late 2000s, my mom said CNY 400k (si4shi2wan4) was a good-enough medical reserve for each retiree, on top of public health insurance (reimbursement-based). Such insurance has coinsurance, and numerous exclusions such as elective treatments [imported medication, supplements,,].

In early 2022 my dad recalled that consensus figure among retirees of that time — regardless of the medical condition, if CNY 500k is spent over and on top of insurance, and still the life can’t be saved, then it’s reasonable to give up. As such CNY 500k was a reasonable last-resort personal medical reserve, for millions of well-informed Chinese retirees.

Fast forward to 2022, CNY 500k-1000k of family savings is common according to my dad, living in Beijing. I think this improvement in savings reflects (medical++) inflation, rising income, rising wealth esp. in rEstate.

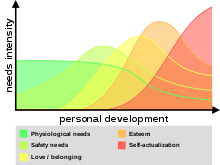

This diagram from

This diagram from